“Learn the history, definition, and confusion behind what makes someone an accredited investor.” So you want to invest in private placements? Welcome to the club! With more than a trillion dollars worth of investment capital passing through this space every year, you’re in good company. But if you’re interested in Regulation D private securities, then…

Category Archives: Uncategorized

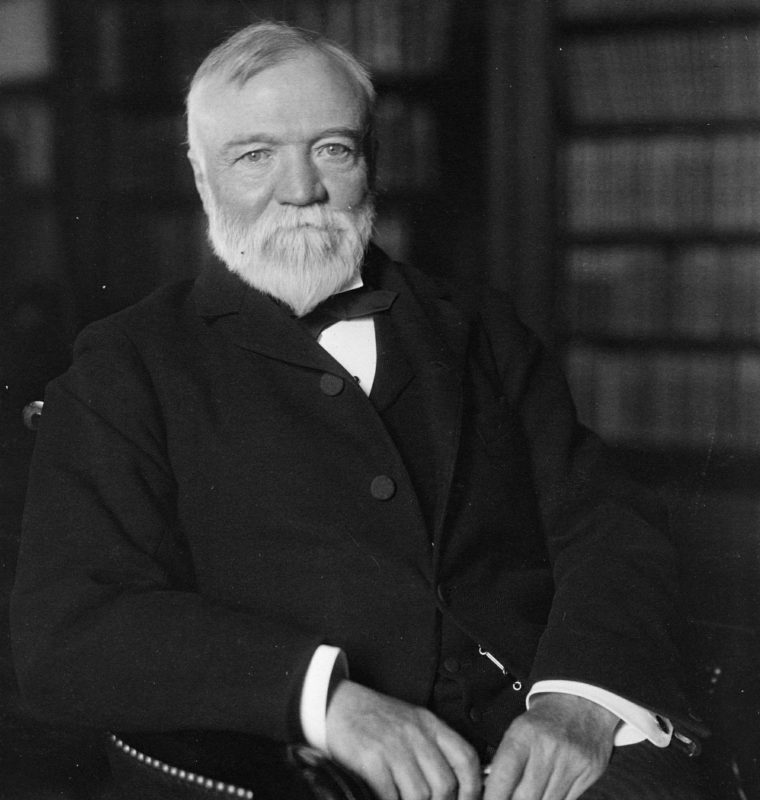

Over the last 40 years, multifamily has outperformed every other real estate asset class with better overall returns, better risk-adjusted returns, and lower volatility. The economic impacts of COVID-19 have resulted in a recession not seen since the Great Depression almost a century ago. Here, we’ll provide data to showcase multifamily performance over the last…

In the financial investing world, asset allocation models are everywhere. There are income models, growth models, and balanced models. There are one-fund, two-fund, and three-fund models. Some people are aggressive with 100% of their portfolio in stocks, while others only invest in bonds. The combinations of what one can invest in are endless. And no…

Do you have a balanced portfolio? Do you periodically rebalance your asset allocation? How many financial horror stories are the result of being out of balance? Allow me to tell you about one that will stick with me for the rest of my life. This one involves a senior partner of mine working in the…

Real estate can be an alternative for those unable to withstand the volatility of the stock market. It is also a better investment for investors who wish to take an active role in growing their capital, rather than passively putting their money into a fund managed by someone else. One of the beautiful things about real estate…

The government provides tax incentives for a whole host of things they deem important. There are incentives for getting married, starting a business, installing alternative energy sources, and so much more. So you know it’s a good bet that tax incentives exist for the basic needs as well. We all know that the basic needs…

Over the last two centuries, about 90 percent of the world’s millionaires have been created by investing in real estate. For the average investor, real estate offers the best way to develop significant wealth. As with any and all forms of investing, it is best to get started early with real estate so you can put time on…

There is no such thing as a free lunch. But there are ways for you to invest in real estate without paying a dime. While real estate isn’t likely to bring overnight success, there are ways to bring in big profits even if you are living paycheck to paycheck. How much money do you need to invest…

In the dynamic world of real estate investing, staying ahead of the curve is crucial for success. As technology continues to evolve, savvy investors are increasingly turning to IT services companies to gain a competitive edge. Leveraging the expertise of these service providers can streamline operations, enhance efficiency, and open up new avenues for growth….

Many people conflate the concepts of real estate investing and passive income. Real estate can be a form of passive investing, but often not in the ways that investors think. Passive real estate investing can be one of the most powerful ways to make your money work for you. But before we discuss the specific…